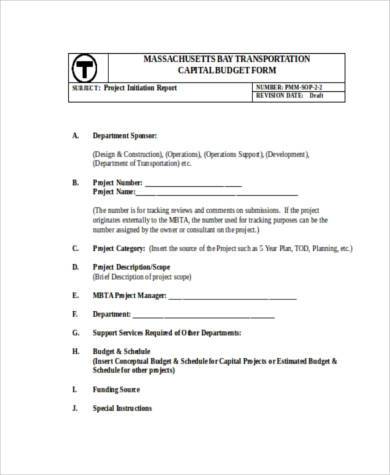

Contents:

chart of accounts example dividends are payouts of profit to stockholders; in other words, distributions of retained earnings. Cash dividends are not paid out of owner investments, or common stock. An individual invests $10,000 of his own cash to open a new corporation’s checking account.

Date Account Debit Credit 6/1 Cash 10,000 ▲ Cash is an asset account that is increasing. Common Stock 10,000 ▲ Common Stock is an equity account that is increasing. Think of common stock as a receipt for an investor infusing money or other assets into the business. A running total of all the investments that people make in a corporation is maintained in theCommon Stock account.

What Can Shareholder Equity Tell You?

The statement of equity is simply the part of a balance sheet or ledger that clearly calculates and explains the stockholders’ (or shareholders’) equity. When a company buys shares from its shareholders and doesn’t retire them, it holds them as treasury shares in a treasury stock account, which is subtracted from its total equity. For example, if a company buys back 100,000 shares of its common stock for $50 each, it reduces stockholders‘ equity by $5,000,000. Multi-year balance sheets help in the assessment of how a company is performing from one year to the next. In the example, this company had experienced a significant year-over-year increase in total assets, from $675,000 to $770,000.

Equity, also referred to as stockholders‘ or shareholders‘ equity, is the corporation’s owners‘ residual claim on assets after debts have been paid. If positive, the company has enough assets to cover its liabilities. Stockholders‘ equity is often referred to as the book value of the company and it comes from two main sources. The first source is the money originally and subsequently invested in the company through share offerings. The second source consists of the retained earnings the company accumulates over time through its operations. In most cases, especially when dealing with companies that have been in business for many years, retained earnings is the largest component.

What is stockholders‘ equity?

The company won’t record this as income until it delivers the packages of the deal. The latter, however, needs to be handled particularly carefully. Read on to find out what liabilities are, how they integrate into all companies’ finances, and why they are vital for businesses through practical examples. Is a collection of financial assets institutions invest in order to fund operations and secure long-term financial stability. New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed.

This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. All investments involve risk, including the possible loss of capital. Past performance does not guarantee future results or returns. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals.

Example of Stockholders‘ Equity

This measure excludes Treasury shares, which represent stock owned by the company itself. As noted above, shareholder equity represents the total amount of capital in a company that is directly linked to its owners. That means it is the total amount of money the owners have invested in it. If the company ever needs to be liquidated, SE is the amount of money that would be returned to these owners after all other debts are satisfied. Treasury shares continue to count as issued shares, but they are not considered to be outstanding and are thus not included in dividends or the calculation of earnings per share .

Fastenal Company Reports 2023 First Quarter Earnings – InvestorsObserver

Fastenal Company Reports 2023 First Quarter Earnings.

Posted: Thu, 13 Apr 2023 10:50:00 GMT [source]

If you purchase this plan, you will receive Financial Counseling Advice which is impersonal investment advice. To be eligible to receive a Stock Reward through stock party, you must complete the account registration process and open an individual taxable brokerage account („Personal Portfolio“) that is in good standing. The money in a custodial account is the property of the minor.

This term refers to the amount of equity a corporation’s owners have left after liabilities or debts have been paid. Equity simply refers to the difference between a company’s total assets and total liabilities. In short, the Equity portion of the accounting equation is the amount left over after liabilities are deducted from assets and represents the residual value of assets minus liabilities. Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners.

Long-term assets include intangibles like intellectual property and patents, along with property, plant, and equipment and investments. When a corporation purchases stock that was previously issued to its investors, the repurchased shares result in a reduction of shareholders‘ equity by the total purchase amount. The stock may be repurchased to distribute excess cash to the company’s shareholders or to reissue them to employees as part of a stock compensation plan.

Generally, the higher the ROE, the better the company is at generating returns on the capital it has available. Companies with positive and growing stockholders‘ equity are usually viewed as financially stable. Unrealized Gains And LossesUnrealized Gains or Losses refer to the increase or decrease respectively in the paper value of the company’s different assets, even when these assets are not yet sold. Once the assets are sold, the company realizes the gains or losses resulting from such disposal. HedgingHedging is a type of investment that works like insurance and protects you from any financial losses. Hedging is achieved by taking the opposing position in the market.

Aside from stock components, the SE statement also includes sections that report retained earnings, unrealized gains and losses and contributed capital. The retained earnings portion reflects the percentage of net earnings that were not paid to shareholders as dividends and should not be confused with cash or other liquid assets. Shareholder equity reported by PepsiCo increased between the 2020 and 2021 fiscal years despite the economic challenges stemming from the COVID-19 pandemic. According to the company’s balance sheet, equity attributable to shareholders was $16.04 billion in 2021 compared to $13.45 billion in 2020.

Share Capital

It is divided into two separate https://1investing.in/s common stock and preferred stock. To compute total liabilities for this equity formula, add the current liabilities such as accounts payable and short-term debts and long-term liabilities such as bonds payable and notes. To determine total assets for this equity formula, you need to add long-term assets as well as the current assets. Current assets are the cash, inventory and accounts receivables.

Hence, Stockholder’s Equity in common language is capital iInvested by the owners in the company. Cash flow statements help businesses keep track of their finances…. Unrealized gains and losses.These are the gains and losses a business sees as a direct result of a change in the value of its investments. Unrealized gains occur when the business has yet to cash in those gains, while unrealized losses are those reductions in value before the investment is unloaded. Financial health can be understood by analyzing the statement of equity as it gives a broad picture of the performance.

Dow announces results from 2023 Annual Stockholder Meeting – PR Newswire

Dow announces results from 2023 Annual Stockholder Meeting.

Posted: Thu, 13 Apr 2023 14:15:00 GMT [source]

It is the difference between total assets and total liabilities. Stockholders‘ equity is the value of a company’s assets that remain after subtracting liabilities and is located on the balance sheet and the statement of stockholders‘ equity. Calculating stockholders equity is an important step in financial modeling. This is usually one of the last steps in forecasting the balance sheet items. Below is an example screenshot of a financial model where you can see the shareholders equity line completed on the balance sheet.

- Throughout this series of financial statements, you can download the Excel template below for free to see how Bob’s Donut Shoppe uses financial statements to evaluate the performance of his business.

- Essentially, retained earnings represent the amount of company profits, net of dividends, that have been reinvested back into the company.

- Equity is the shareholders’ “stake” in the company as measured by accounting rules.

- A summary report called a statement of retained earnings is also maintained, outlining the changes in retained earnings for a specific period.

- Subtract the liabilities from the assets to reveal the total shareholders’ equity.

In other words, stockholders‘ equity is the total amount of assets that the investors will own once debts and liabilities are paid off. Stockholders‘ equity is the total amount of capital given to a company by its shareholders in exchange for stock, plus any donated capital or retained earnings. Most recently she was a senior contributor at Forbes covering the intersection of money and technology before joining business.com. Donna has carved out a name for herself in the finance and small business markets, writing hundreds of business articles offering advice, insightful analysis, and groundbreaking coverage.

This is also a share in the company, but it takes a back seat to preferred stockholders when it comes to paying out equity. For example, if the business decides to liquidate, preferred stockholders will get paid before common stockholders do. However, common stockholders tend to have voting rights, whereas preferred stockholders usually don’t.